Automation simplifies complexities

Streamline and automate even complex subscription billing scenarios as you scale locally and across borders.

Book my demo Try it free

Recurring billing automation overview

See how Recurly streamlines billing while maintaining compliance with global tax and payment regulations.

Subscribers want flexibility, speed, and simplicity

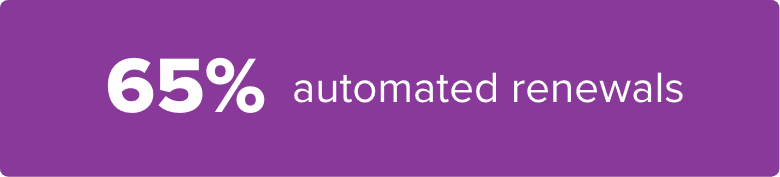

52% of customers cite contract flexibility as the most important factor when choosing subscriptions. 53% want easy pauses and options to cancel. And a full 65% like automated renewals.

It’s clear that subscribers want it their way—and Recurly delivers. By offering flexibility, simplicity, and automation, businesses can win and retain the business of unique subscriber requests.

Simplify the entire subscription billing cycle and confidently scale locally and abroad

Automate subscription billing and invoicing

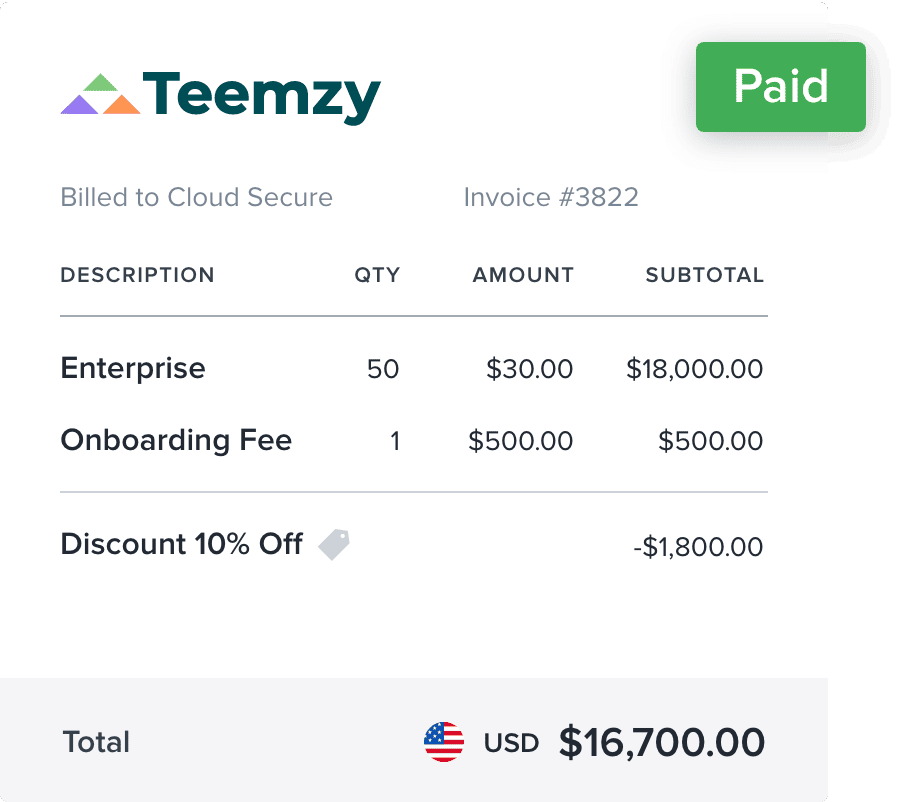

Embrace automated invoice creation with precise tax calculations—wherever you do business. Streamline and simplify recurring billing across plan purchases, renewals, and adjustments using a variety of flexible billing options. Spend time and effort on your product and leave the billing lift to Recurly.

Tackle subscription complexity with flexibility

Translate complexities into simplicities with customization capabilities that allow you to flex, adapt, and evolve. Explore and enter new markets and customers with multiple currencies and payment methods, customizable invoice and receipt formats, myriad billing terms, and variable contract details.

Scale up, out, and around with peace of mind

Put your development team back to work doing what they do best. Recurly has the tools to keep payment processing and billing secure and compliant everywhere you want to go. With the right language, currency, billing formats, and payment methods, you can confidently scale across borders.

Key features

Handle complex billing scenarios as you grow. Recurly helps you deliver new revenue opportunities and new markets with flexible billing workflows and automated, customizable invoicing.

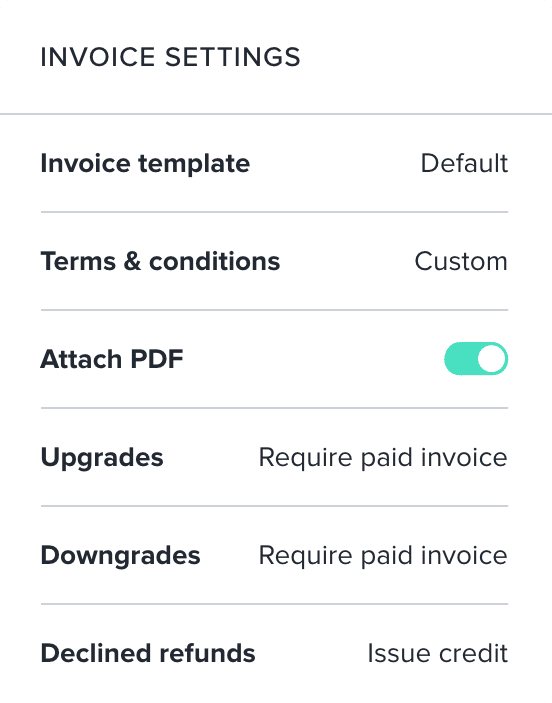

Automated invoicing gets the bill out

Allow Recurly to automate the entire recurring billing and invoicing cycle—while still accommodating the occasional manual invoice.

- Available in 20+ languages

- Configurable terms and conditions

- Optional PDF invoice format

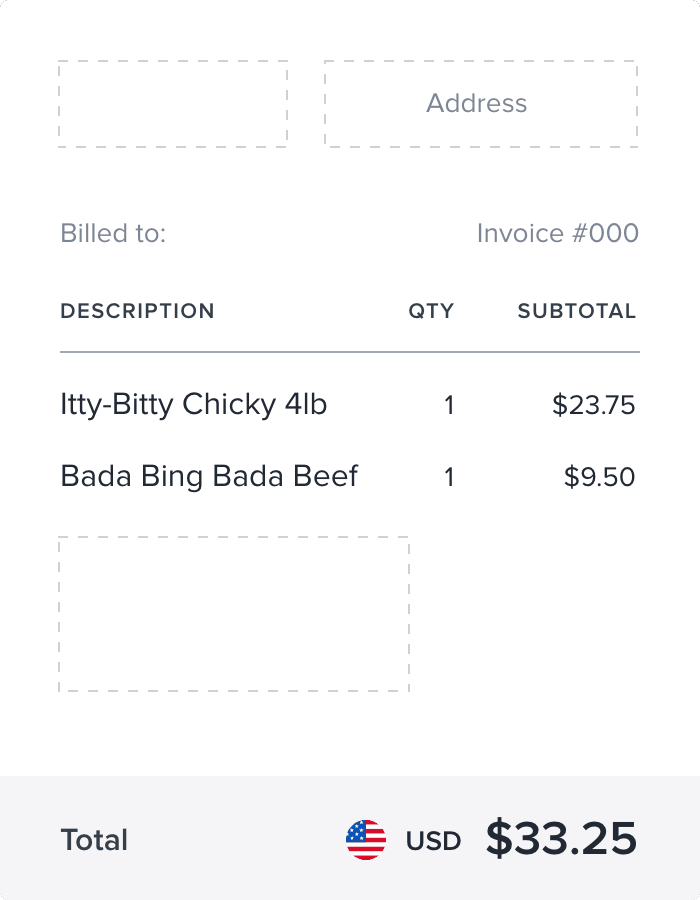

Invoice and receipt customization make it uniquely yours

Adapt to the changing needs of your business with customizable invoices and receipts. Have customers that need a certain data bit included or excluded? Have multiple entities with different logos and contact info? Recurly makes it possible.

- Customize receipt templates including header and footer

- Assign templates to individual accounts

- Preview templates for design

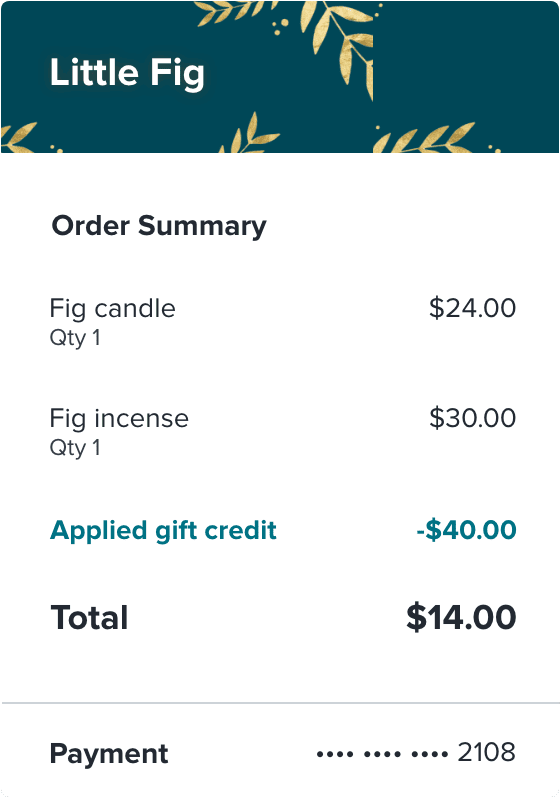

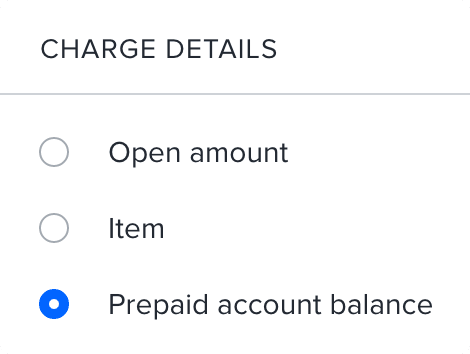

Charges and credits make the adjustment

Most charges and credits are created automatically in subscription billing. With Recurly, you can manually or programmatically create custom charges and credits on customer accounts, either billed separately or included with the next subscription invoice.

- Most credits and charges are automated

- Manual charges/credits bill separately or with next subscription invoice

- Purchase can include gift card applications

Taxes and compliance, because certainty matters

Scale confidently with tax and compliance tools that follow your business around the globe. Automatically calculate and collect taxes, including VAT and GST, from customers in 47 countries.

- Configure taxable regions at the country and state/province level

- Tax based on the billing or physical address, which is automatically validated for accurate collection

- Connect with Avalara and Vertex for expanded functionality

Identify growth opportunities with advanced subscription analytics

Gain deep insights into business performance with advanced subscription analytics via charts, tables, and graphs that allow you to optimize what’s working and tweak what’s not.

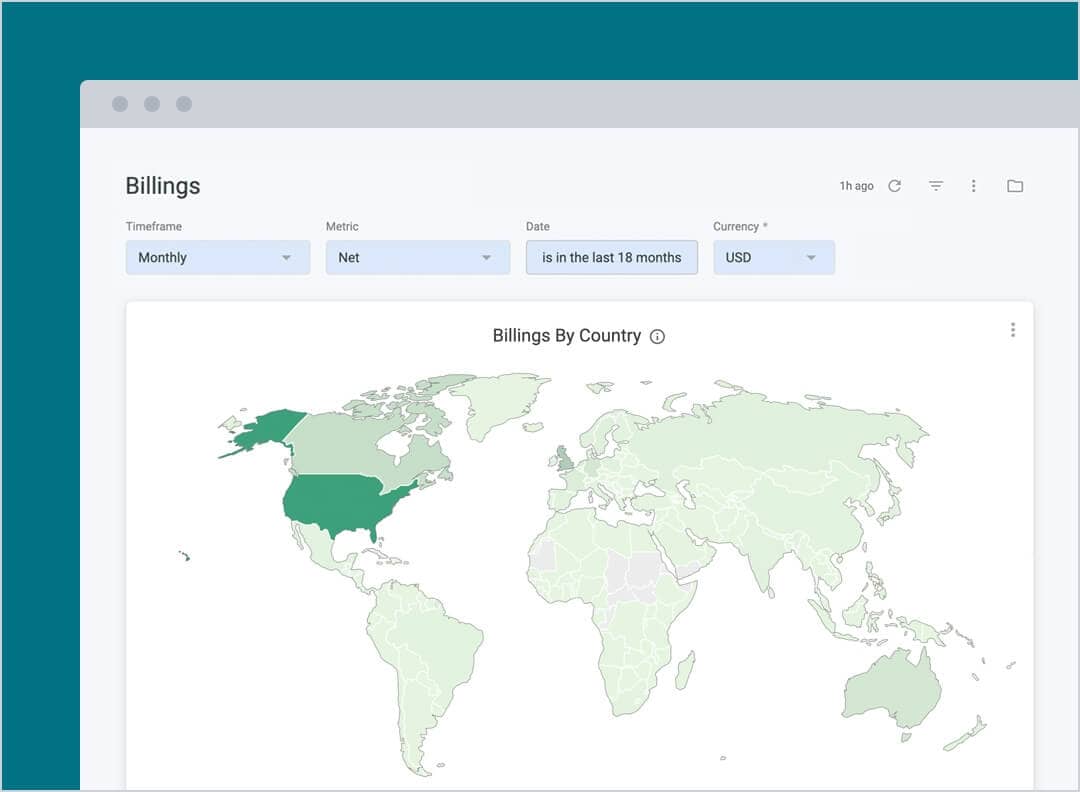

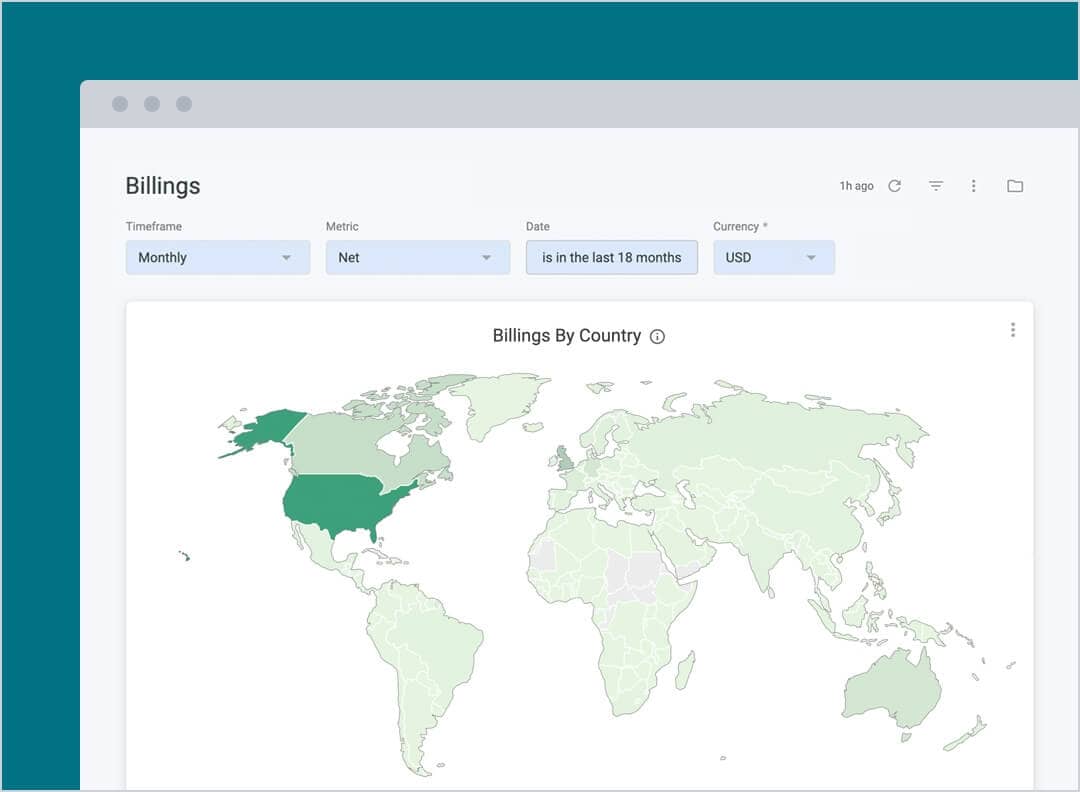

Learn more about reporting & analyticsBillings

Calculates the total amount of successful payments, refunds, and the net of the two over a selected time period, detailing new and renewing customers.

Views billing performance across country (if global) and by state.

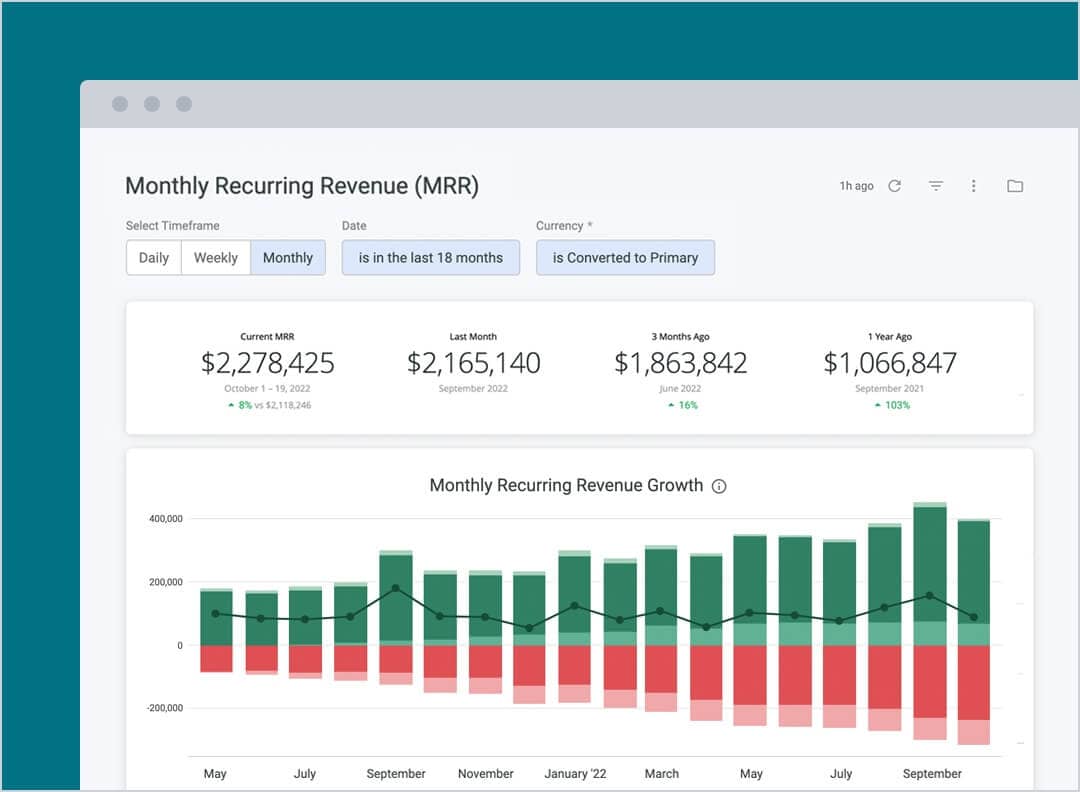

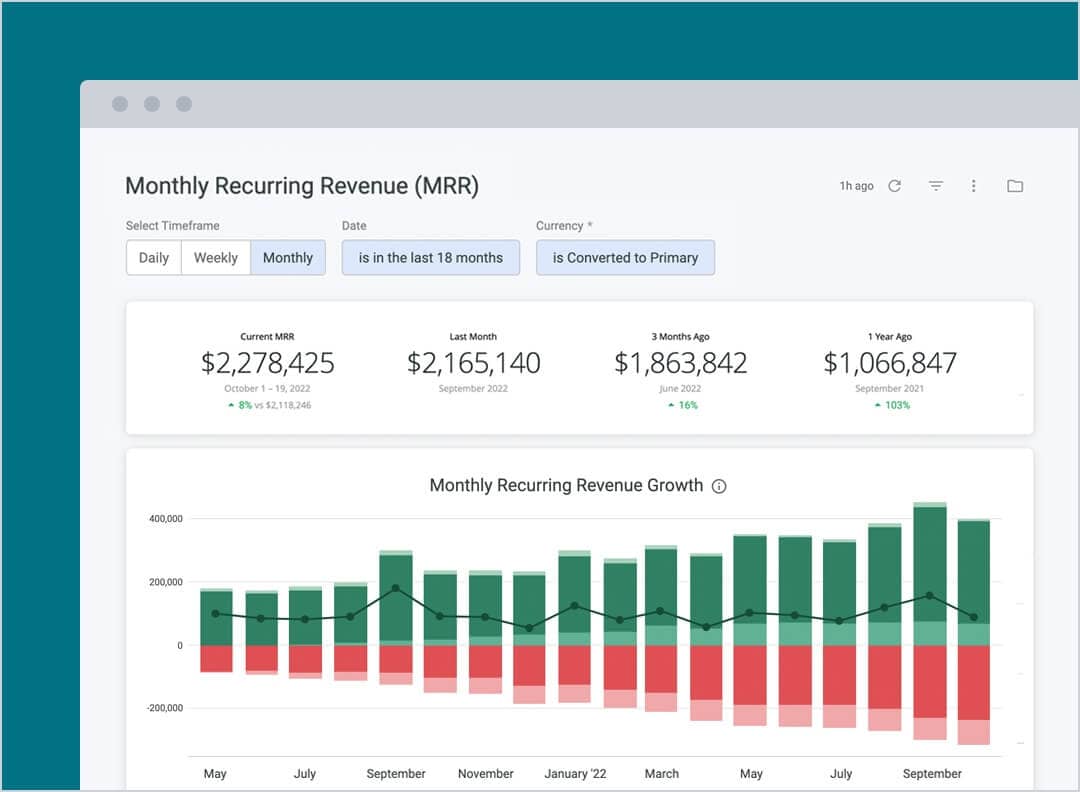

Monthly recurring revenue

Measures the predictable revenue a business expects on a monthly basis by tracking total MRR and MRR changes.

Helps monitor and evaluate business growth and revenue momentum.

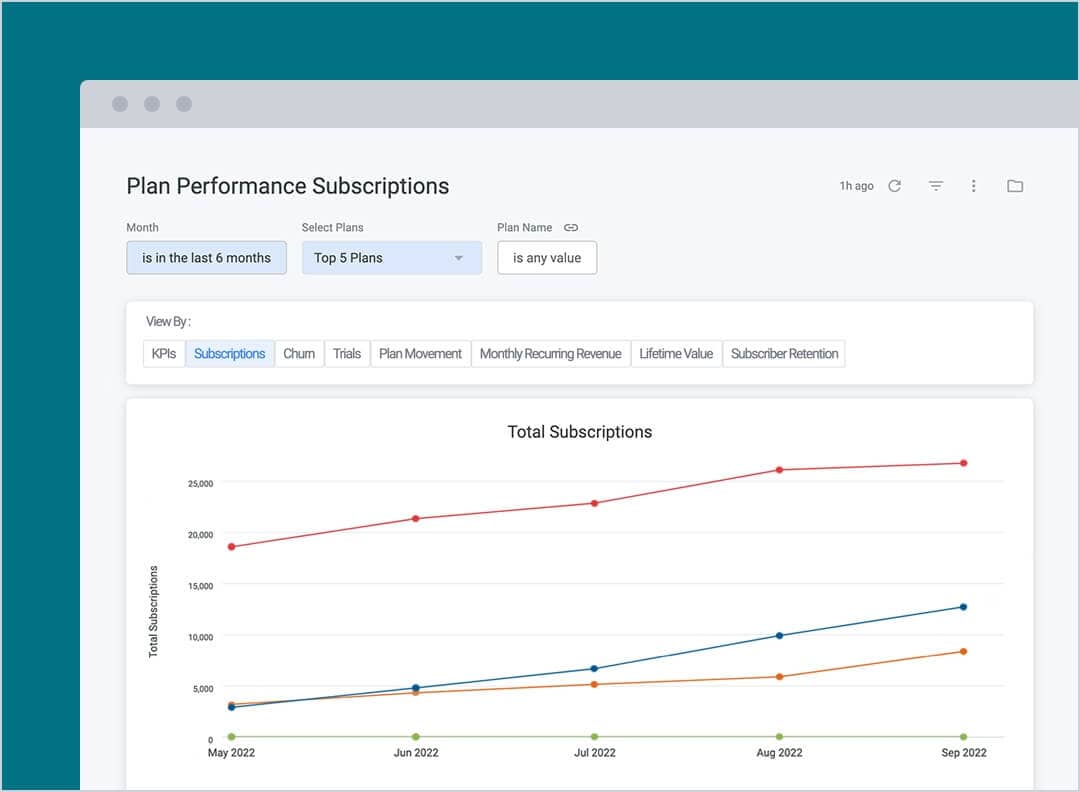

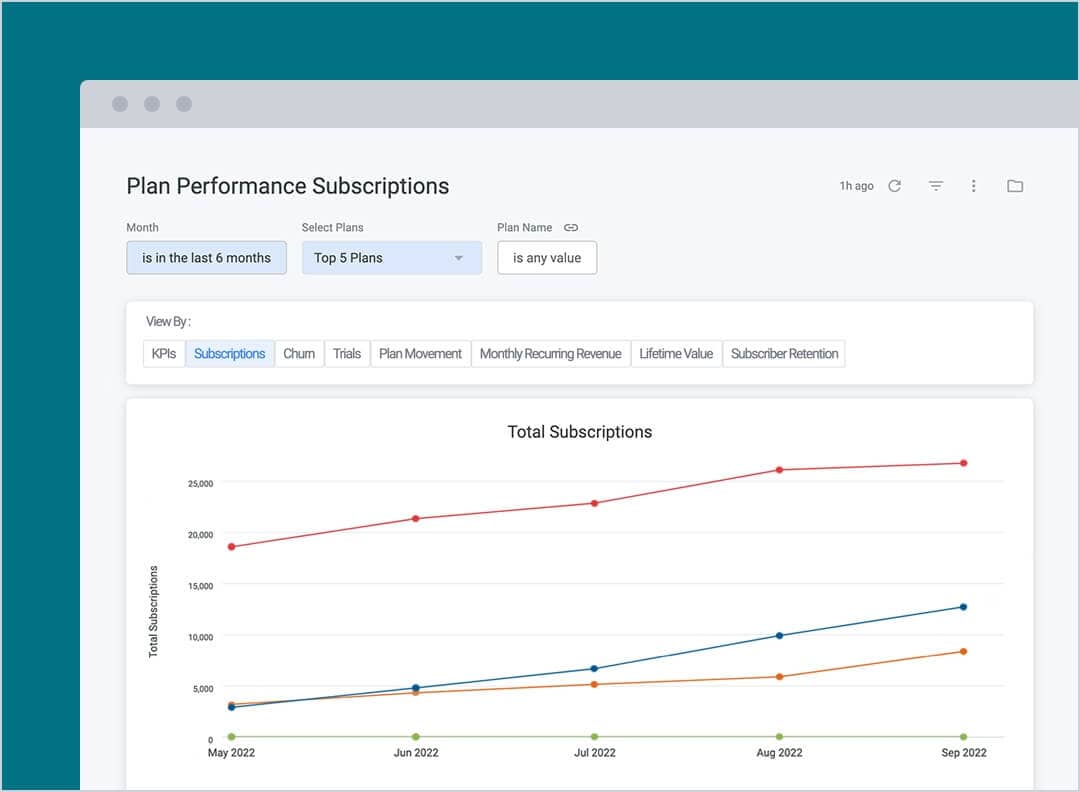

Plan performance

Evaluates the performance of a plan after pricing, plan length, or promotional changes.

Compares attributes of different plans, such as trial or plan length, to gauge which plan is most successful.

Get connected through the Recurly partner ecosystem

Seamlessly extend your existing workflows and tech stack with pre-built integrations for dozens of CRM, ERP, and data systems, as well as gateways, accounting, tax, and fraud solutions.

View all partner integrationsAvalara

Turn on a powerful sales tax engine right within your Recurly site to dynamically calculate and deliver real-time sales tax decisions based on precise geolocation in the U.S.

Learn moreVertex

Enable global tax calculation on Recurly invoices with parameters that work for the most common taxation scenarios by connecting to a Vertex O Series or Vertex Cloud account.

Learn moreOracle NetSuite

Enhance your subscription process by syncing billing and customer subscription data from your Recurly plans to the financial and accounting data in your Oracle NetSuite environment.

Learn moreQuickBooks Online

Enable automatic transfer of Recurly customer accounts and items, along with data from invoices, payments, and refunds to QuickBooks, improving data accuracy and revenue accounting process.

Learn moreExperience matters. Enjoy unmatched, proven scalability with Recurly.

$12B

annual total payment volume

$1.2B

annual recovered revenue

140+

local currencies supported

96%

annual renewal invoice paid rate

Frequently asked questions

What is recurring billing?

Recurring billing is a payment model where businesses bill customers at predefined intervals (e.g., weekly, monthly, yearly) for products or services. Read our “Definitive Guide to Recurring Billing and Subscription Commerce” to learn more.

What type of businesses is recurring billing most suited for?

Recurring billing is used by businesses in many industries, including SaaS, media and entertainment, consumer goods and retail, elearning, and professional services.

Are subscriptions and recurring billing the same?

Subscriptions refer to purchases by prepayment for a certain number of regular deliveries (such as box-of-the-month clubs) or for a certain period of access to something (such as a streaming media service). Recurring billing refers to the typical subscription payment model where businesses bill customers at predefined intervals for the product or service.

What are the types of recurring billing?

Recurring billing can be based on several models, including fixed recurring, quantity based, usage based, one-time, hybrid, or ramp pricing.

What are the advantages of recurring billing? What are the challenges of recurring billing?

Recurring billing offers advantages to both merchants and customers. Merchants enjoy monthly recurring revenue while customers enjoy new products and services at a predictable price. The challenges of recurring billing include subscription management, plan and pricing management, secure payment processing, and failed payments.